Interest only mortgage repayment calculator

Building a Safety Buffer by Making Extra Payments. This will reduce the overall amount that you will be paying on interest for the loan reducing it from.

Excel Formula Calculate Loan Interest In Given Year Exceljet

The average interest rate on a 30-year fixed-rate mortgage was 267 APR on Dec.

. Based on term of your mortgage interest rate and mortgage amount. Using an interest-only mortgage payment calculator shows what your monthly mortgage payment would be by factoring in your interest-only loan term interest rate and loan amount. Interest rates also vary with market conditions but for 2019 the interest rates for personal credit ranges from about 6 to 36.

Such as Skipton Building Society also offer part and part mortgages which combine a repayment and interest-only mortgage. Pop up mortgage calculator. Thats the lowest average rate since at least 1971 the Federal Reserves earliest published rate.

Use Mortgage Repayment Calculator to calculate monthly extra payments amount of interest paid also with offset account on your home loan or mortgage. Whether youre refinancing or just wanting to understand how much you can afford all you have to do is enter how the amount you would like to borrow interest rate home loan term payment frequency and repayment type either principal. Looking for an interest-only mortgage calculator.

Use our mortgage calculator to work out your monthly repayments. To figure out your interest-only. Interest Only Mortgages.

1 Interest is charged monthly. Choose mortgage calculations for any number of years months amount and interest rate. Use this handy mortgage calculator to work out the monthly costs and the total cost including the interest of a capital repayment or interest only mortgage.

Actual interest rates will vary depending on an applicants credit score repayment history income sources and the lenders own standards. Calculate total monthly mortgage payments on your home and what it will take in extra monthly payments to pay off your mortgage sooner. Mortgage rates have been falling more or less steadily since 1981 when average mortgage rates topped out at over 18 APR.

Based on the figures which have been entered into our Mortgage Early Repayment Calculator. You can compare the monthly cost of your mortgage on a repayment agreement versus an interest-only deal by using our calculator below. How to Calculate Payments.

The result is your. While this means your initial monthly repayments will be smaller you will end up paying more in. Interest-only loans are structured as adjustable-rate mortgagesWe also offer an I-O ARM calculator and a traditional ARM loan calculatorWith interest-only loans homeowners do not build equity in their homes unless prices rise which puts them in a precarious position if house prices fall or when mortgage rates rise.

You can apply online or over the phone. The borrower only pays the interest on the mortgage through monthly payments for a term that is fixed on an interest-only mortgage loan. If you paid the mortgage on a repayment basis youd owe the lender nothing and own the property outright at the end of the term.

Interest rates remain the same for the term of the loan whereas interest rates are subject to change. The calculated monthly repayment is either halved and paid towards your loan fortnightly or quartered and paid towards your loan every week. Free interest calculator to find the interest final balance and accumulation schedule using either a fixed starting principal andor periodic contributions.

Home loan repayment calculator. And the sum becomes Dereks required repayment to the bank one year later. An interest-only mortgage can make a mortgage more affordable but in this case it would mean that in 25 years time youd still owe the lender 200000.

It has only been designed to give a useful general indication of costs. As the name suggests a PI loan has repayments which include both principal the amount owing on a loan and interest the. 100 10 110.

Our Interest Calculator deals with fixed interest rates only. An interest-only loan is simply a loan where the borrower is obligated to pay only the interest on the loan for a certain period of time whether that be for a portion of the loan period or the entire loan period with the obligation to pay back the principal of the loan at the end of loan period. Whether youre a first-time buyer home mover or youre remortgaging you can calculate your estimated monthly repayments with our mortgage repayment calculator.

The term is usually between 5 and 7 years. This calculator is not intended to be your sole source of information when making a financial decision. Youll need to have a clearly understood and credible repayment strategy in place to repay your Interest Only or Part Part mortgage.

Simply enter the total capital required for your home loan the term of the mortgage and the interest rate. A PI also known as P and I or Principal and Interest is the most common type of loan repayment structure. 2 Interest rate stays the same over the term.

All repayment strategies will be subject to approval by our mortgage underwriters. Mortgage calculator with Extra Payments. If you continuously pay an amount of on a monthly basis then you will be able to repay your mortgage off in months quicker than if you paid the regular monthly installment of.

Essentially youre delaying repayment on the principal itself and reducing your monthly mortgage payments in the short term. That also means however that youll wind up spending more on housing costs once the interest-only period comes to an end. This can make the repayment more manageable as you will chip away at some of the.

An explanation of the two different types of mortgage can be found here. Interest-only repayments mean youre only paying down the interest portion of the loan. After the term is over many refinance their homes make a lump sum payment or they begin paying off the principal of the loan.

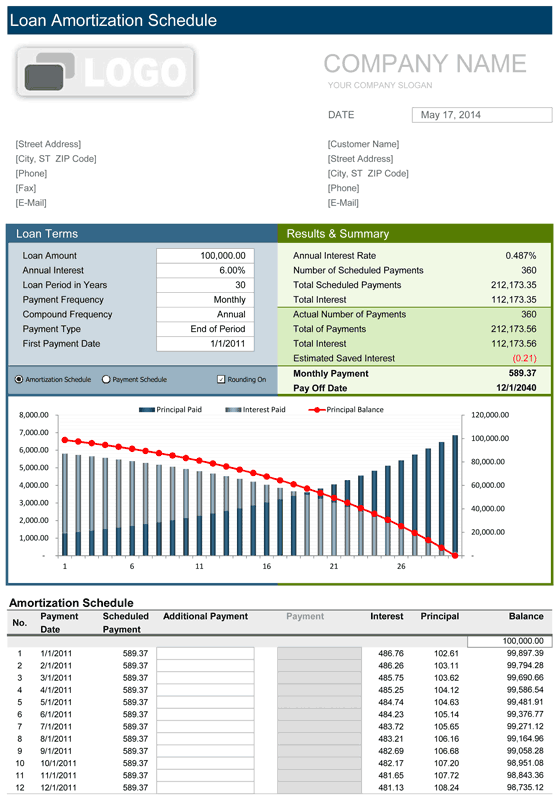

Use our home loan calculator to estimate what your monthly mortgage repayments could be. The graph displays the periodic repayments for an interest-only loan and the repayments for a comparable principal and interest loan with the same amount borrowed interest rate repayment frequency and fees as the interest-only loan. Mortgage repayment calculator.

3 If you selected Interest only we assume your standard monthly payment doesnt decrease. The extra amount paid and frequency increase reduces the loan term and total interest paid.

Adding An Interest Only Period To An Amortization Schedule 1 Of 2 Youtube

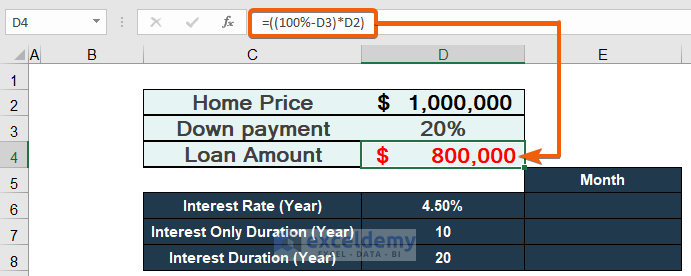

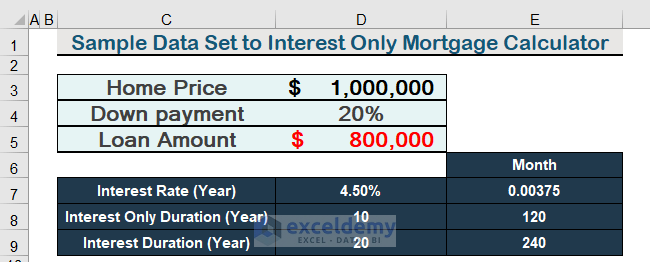

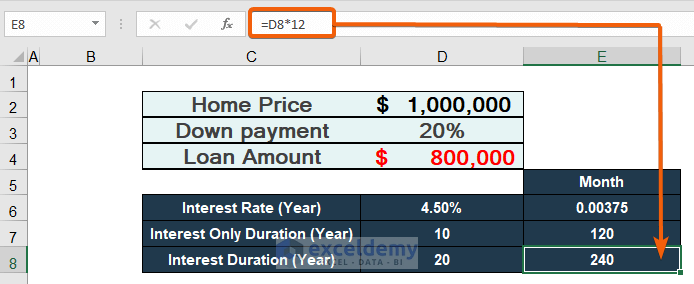

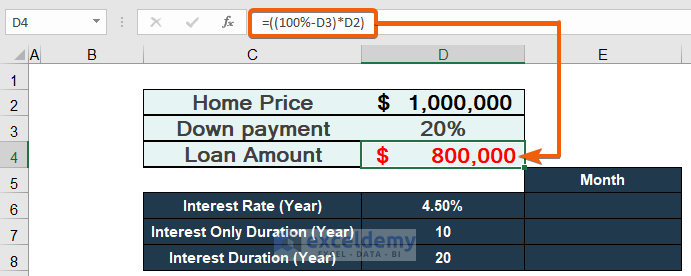

Interest Only Mortgage Calculator With Excel Formula A Detailed Analysis

Interest Only Mortgage Calculator

Downloadable Free Mortgage Calculator Tool

Interest Only Mortgage Calculator With Excel Formula A Detailed Analysis

Interest Only Mortgage Calculator With Excel Formula A Detailed Analysis

Interest Only Calculator

Balloon Loan Calculator Single Or Multiple Extra Payments

Interest Only Calculator

Simple Interest Loan Calculator How It Works

Interest Only Loan Calculator Simple Easy To Use

Mortgage Repayment Calculator

Free Interest Only Loan Calculator For Excel

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Interest Only Loan Calculator Free For Excel

Interest Only Loan Calculator Free For Excel

All In One Interest Only Loan Calculator Financeplusinsurance