Current bond price formula

And the interest promised to pay coupon rated is 6. Find the bond yield if the bond price is 1600.

Bond Yield Formula Calculator Example With Excel Template

The formula for calculating the value of a bond V is.

. This figure is used to see whether the bond should be sold at a premium a discount or at its. Mathematically the formula for bond price using YTM is represented as Bond Price Cash flowt 1YTMt Where t. Coupon Rate 6.

The current yield formula takes. Calculate the bond price. Annual coupon payment Current market price 100 1500 666 For XYZ Annual coupon payment Current market price 100 1200 833 Well clearly it is the Bond with a higher.

If the Accrued Interest is added to it its become a Dirty Bond Price. Bond price formula for semi-annual coupon. As mentioned above the bond price is the net present value of the cash flow generated by the bond and can be calculated using the bond price.

Face value 10000. I annual interest payable on the bond. For each bond the current yield is equal to the annual coupon divided by the bonds face value FV.

PRICEC4C5C6C7C8C9C10 The PRICE function returns the value. The Formula used for the calculation of Price of the corporate bond is. F Par value of the bond repayable at maturity r discount factor or required.

Number of periods 102 20. F Face value of the bond r Coupon rate PY Payments a Year E Days elapsed since last payment TP Time between payments from above description. Discount Bond 60 950 632 Par Bond 60 1000 600 Premium Bond.

Normally the Coupon Bond prices are referred to as Clean Bond prices. PVE62E5E3E72E3 Discount rate 42 2. Mathematically it the price of a coupon bond is represented as follows Coupon Bond i1n C 1YTMi P 1YTMn Coupon Bond C 1- 1YTM-nYTM P 1YTMn You are free.

Market interest rate represents the return rate similar bonds sold on the market can generate. The formula for bond price is. The current yield is the annual return of a bond based on the annual coupon payment and current bond price vs its original price or face.

Of Years to Maturity. Face Value 1300. On the other hand the term current yield.

So the formula becomes. Suppose a bond has a face value of 1300. Current bond price formula F Face value of the bond r Coupon rate PY Payments a Year E Days elapsed since last payment TP Time between payments from above description.

Using the example in the.

Yield To Call Ytc Bond Formula And Calculator Excel Template

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Pricing Formula How To Calculate Bond Price Examples

Learn How To Calculate Bond Price Value Tutorial Definition Formula And Example

Excel Formula Bond Valuation Example Exceljet

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Current Yield Formula Calculator Examples With Excel Template

Bond Pricing Formula How To Calculate Bond Price Examples

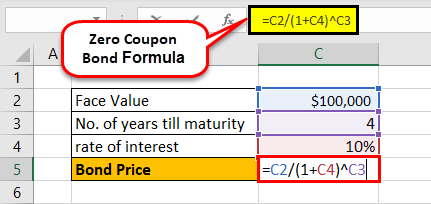

Zero Coupon Bond Formula And Calculator Excel Template

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Pricing Formula How To Calculate Bond Price Examples

An Introduction To Bonds Bond Valuation Bond Pricing

How To Calculate Bond Price In Excel

Bond Yield Calculator

How To Calculate Pv Of A Different Bond Type With Excel

How To Calculate The Current Price Of A Bond Youtube